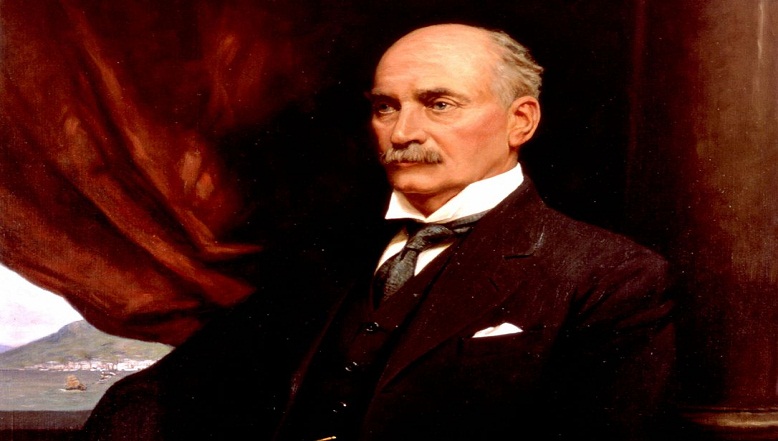

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in India

Our services

We offer a comprehensive range of services to our customers in India, catering to both resident as well as non-resident Indians across the globe.

For high-net-worth and ultra-high-net-worth individual, including professionals, entrepreneurs, and their families with investable assets exceeding US$2 million, we offer an extensive array of tailored solutions and bespoke services designed to meet their unique needs.

For business and corporate clients, we deliver a suite of services, including business accounts, global payments solutions, trade services, and a variety of borrowing options.

For corporate and institutional clients, our offerings encompass transaction banking, treasury services, investment banking, advisory, capital markets, foreign exchange, fixed income, and derivatives.

Our headquarters

52/60 Mahatma Gandhi Road

Mumbai

Maharashtra

400001

Our CEO

Hitendra Dave

Our history in India

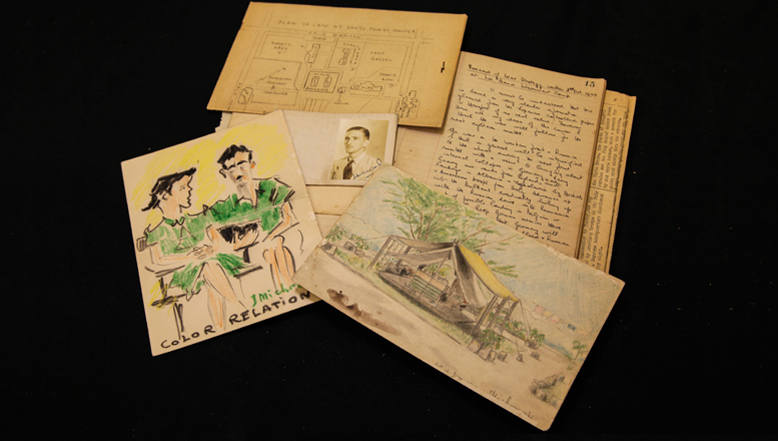

HSBC’s origins in India date back to 1853 when the Mercantile Bank of India was established in Mumbai. The bank has grown steadily and now offers products and services to corporate and commercial banking clients and retail customers.

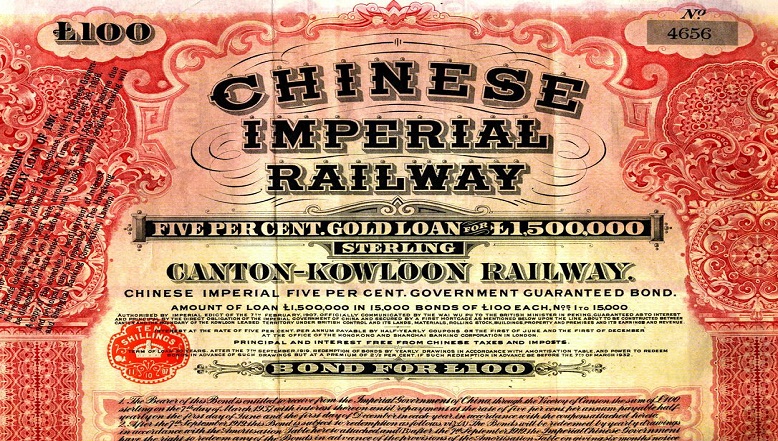

The Mercantile Bank of India, London and China was founded in Bombay (now Mumbai). By 1855, the Mercantile Bank had opened offices in London, Madras (Chennai), Colombo, Kandy, Calcutta (Kolkata), Singapore, Hong Kong, Canton (Guangzhou) and Shanghai. In 1950 it moved into its new head office building at Flora Fountain in Mumbai.

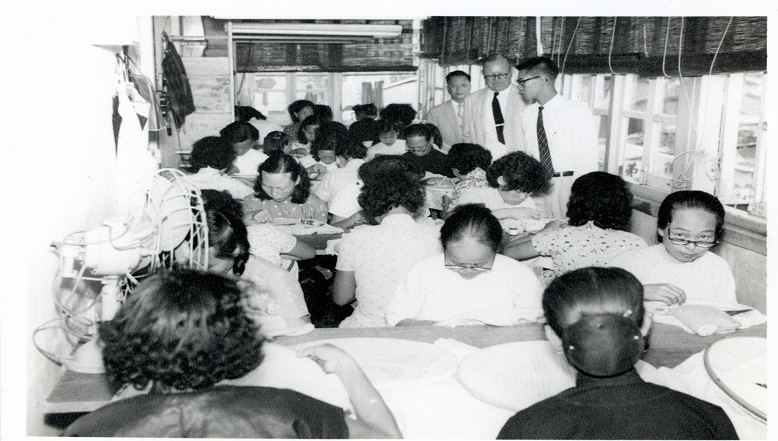

The Mercantile Bank was bought in 1959 by The Hongkong and Shanghai Banking Corporation Limited. Founded in 1865 to serve the needs of the merchants of the China coast and finance the growing trade between China, Europe and the US, HSBC has been an international bank from its earliest days.

HSBC in India has been active in the development of the Indian banking industry – even giving the country its first ATM in 1987.